Mechanical engineering firm Surface Finishing Engineering (SFE) has received £357,000 in R&D tax relief after developing a machine that revolutionises the way aircraft engines are cleaned and halves the time that aircraft are out of action.

Engines such as those that power the Boeing 777 are as much as 2m in diameter. In the air, they draw in sand, dirt and airborne debris. It can take 30 days for an engine to be dismantled, chemically cleaned, inspected under UV light and then reassembled.

Wolverhampton-based SFE specialises in providing turnkey solutions for surface treatment lines where special chemical processes are required on metallic parts and components. It was asked by one of its customers to come up with a way of reducing the time it took to clean aeroengines so aircraft could get back in the air more quickly.

The company experimented with speeding up existing processes but that did not create the required improvement. The most time-consuming part of the engine to clean is the main high-pressure turbine: because it is extremely heavy a lot of the cleaning had to be done manually, dipping the components into treatment tanks individually.

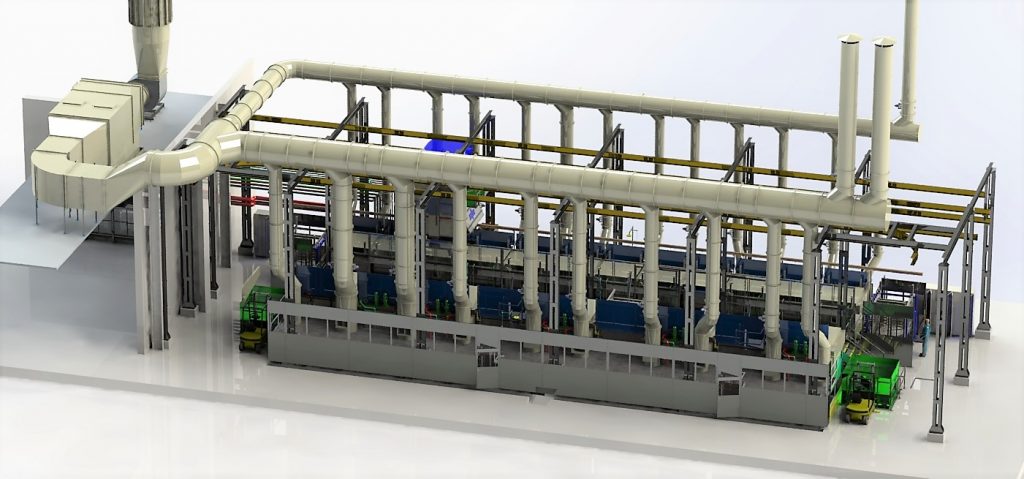

SFE created a completely new piece of machinery to reduce the cleaning time to 14 days – a 50% gain. The new machine is capable of housing the turbine while it is cleaned, meaning it no longer has to be taken apart.

It includes ductwork, routers, chemical tanks and a series of integrated cooling systems, together with an entirely new computer interface and control system. It still uses chemical dipping, but the company’s researchers realised they could use ultrasound to make the process more effective. Using ultrasound transducers incorporated into the chemical tanks, ultrasound waves cause cavitation which allows the chemicals to work much more effectively..

The R&D credit was a welcome boost to SFE’s cash flow during the Covid-19 lockdown.

R&D tax credits were introduced by the government in 2000 to incentivise innovation, and result in either a reduction in a company’s corporation tax bill or a cash lump sum.

SFE was advised by specialist R&D tax consultancy Catax, which says that many firms fail to realise the work they do qualifies as R&D, defined as any work that seeks to resolve a scientific or technological uncertainty. The work does not have to be successful to qualify and claims can be made up to two years beyond the end of the tax year in which the work took place.

SFE business development director Vic Delveir said: “We had never claimed R&D tax credits in the past. I was taken a bit by surprise when the scale of the benefit became clear. A sum of this magnitude is going to help us navigate what is going to be an extremely challenging time for the aviation industry.”

Catax associate director Kully Nijjar can be contacted at Kully.Nijjar@catax.com